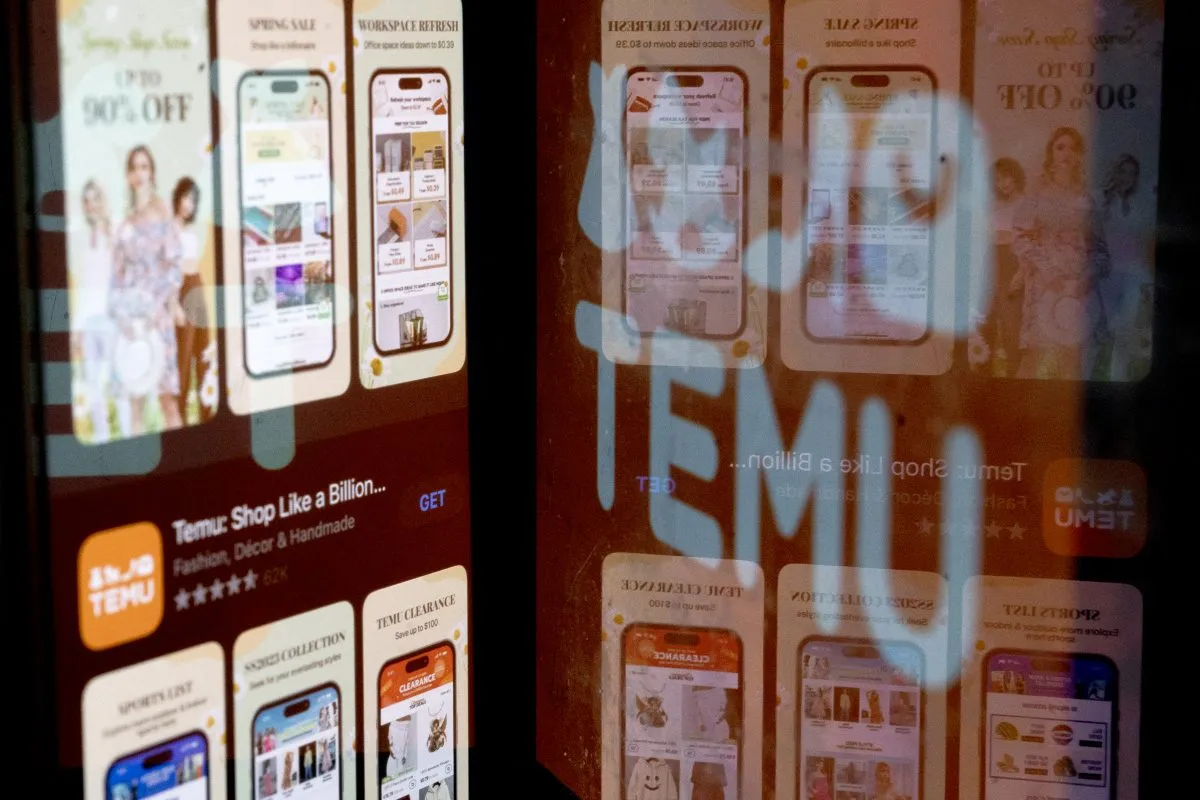

In January, the e-commerce marketplace Temu launched in South Africa, as the Chinese giant PDD Holdings begins its expansion into Africa.

PDD Holdings was founded in Shanghai in 2015, with the Pinduoduo platform launching in the same year. Pinduoduo is a third-party marketplace that connects buyers with sellers and has become known for offering heavily discounted consumer goods. The company makes its profits by taking a percentage of each transaction and charging merchants for advertisements.

Pinduoduo, which generated 130 billion yuan ($18bn) in revenue in 2022, has become particularly profitable because of its extremely lean business model. For one, the company has a much smaller workforce than similar firms. PDD had fewer than 13,000 employees at the start of 2023 compared to Amazon’s 1.5 million head count, helping the company keep costs down.

Part of the reason for this small workforce is that, unlike its competitors, PDD also outsources its fulfilment and distribution functions to third parties. Although this is unusual for a company of PDD’s size, the model has allowed PDD to achieve the highest profit margins of any Chinese e-commerce platform.

While the company has faced some criticism in China over the years – with some alleging that PDD has sold low-quality or even counterfeit goods – this has done little to stem its rapid growth. In the first quarter of 2023, Pinduoduo had 623 million monthly active users in China alone.

PDD initially ran at a loss but, in the third quarter of 2020, started posting profits. These profits have grown steeply since then, with PDD posting a net profit of $8.455bn for 2023, a number which was up almost 85% compared to the year before. PDD, which was listed on the Nasdaq in 2018, has now reached a stock market capitalisation surpassing $150bn.

With the Chinese company now highly profitable, PDD is attempting to take the Pinduoduo model global with its Temu marketplace, through which consumers around the world can access consumer products manufactured and shipped from China. Temu is now active in over 50 countries and, with its recent launch in South Africa, has entered the African market for the first time.

M’khuzo Mwachande, an investment banker in Cape Town, tells African Business that PDD’s expansion into Africa is driven by a desire to open up access to fast-growing markets.

“The Chinese market, where PDD primarily operates, is becoming increasingly competitive and saturated,” he says. “With concerns about China’s ageing population and declining workforce, PDD may be looking to diversify its revenue streams and tap into new markets with potential for growth. Africa, with its large and youthful population, presents an attractive opportunity for PDD to expand its userbase and increase sales.”

Christian-Geraud Neema Byamungu, a China-Africa analyst based in Port Louis, adds that “other big Chinese companies, such as Alibaba and AliExpress, have been in the African market for quite some time already. They all realise that Africa is becoming a large market with lots of consumers wanting to take advantage of what Chinese e-commerce companies are putting on the table.”

The attraction of cheap goods

Byamungu also notes that Chinese platforms are at an advantage in Africa compared to European or American rivals because they are able to provide lower-cost products.

“Africa is a market of huge opportunity; we have a huge number of people eager to buy from Chinese platforms,” he tells African Business. “Because of their purchasing power, most African consumers cannot buy clothes or other products from Europe because the costs are much higher.”

“Buying from China is cheaper, and Africans recognise that the goods coming are of much better quality than used to be the case. For all these reasons, Africa is a burgeoning market where any Chinese e-commerce venture wants to be.”

While Temu’s launch in South Africa continues apace, Byamungu says that the company will face significant challenges should it wish to expand into other parts of the continent.

“The biggest problem they will face is entering markets where there are no strong logistic companies able to cover the business-to-consumer element – the “last mile” of delivery direct to consumers,” he explains. “These logistics-related problems would cause big difficulties in terms of implementing their business model.”

“The Democratic Republic of the Congo, for instance, is a huge market. There are plenty of consumers and businesses wanting to buy from Chinese stores. But since the DRC has a very poor logistics system, it can take products three or four months to arrive,” Byamungu says.

“The B2C, last mile delivery services are the key to the success of their business model in Africa. The absence of this could be a hindering factor in the expansion of Temu elsewhere on the continent.”

Local fears

The launch of Temu in South Africa has not been without controversy, with some local producers fearful that the Chinese e-commerce giant could undercut domestic companies with its ultra-low prices.

The Southern African Clothing and Textile Workers Union has also alleged that tax loopholes could put Temu at an unfair advantage. South Africa allows low-value goods to enter the country without customs declarations or duties, meaning PDD is able to bring its products into South Africa without having to face any additional charges.

Mwachande believes that Temu’s launch in South Africa “raises questions about market competition and sustainable business practices.” However, he also notes that African consumers are likely to be attracted to Temu regardless because of the extremely low prices available and therefore “local companies will lose out.”

“Particularly given the status quo in Africa – high unemployment rates, limited access to financial services, high poverty rates, and high levels of income inequality – the rational decision for African consumers will be to opt for cheaper products, even regardless of quality,” he says.

“Most local companies in Africa do not have strong brand awareness. Given all of this, it is likely that local companies will lose out from Temu’s launch in South Africa.”

However, Byamungu suggests that these fears are mainly unfounded. “Let’s face it, in most African countries, you don’t have a lot of local producers manufacturing products. It’s not as if Chinese companies are undercutting strong local markets,” he says. “I understand the frustration, but it’s not really warranted when you take into account the absence of local manufacturers in many African economies.”

Byamungu believes that the entry of Temu and other marketplaces into the African market could in fact drive higher growth for local companies. He argues that “having access to these e-commerce platforms is a huge advantage for African countries – these platforms are creating new business for local people.”

“Lots of local people in African markets are buying cheap goods in bulk from platforms like Alibaba and now potentially Temu,” he says. “They can then resell those goods or use them to make new products such as clothes, with a good margin. Temu can become a tool for creating businesses and creating wealth.”

There have been some attempts to pushback against Temu in South Africa from local players. Earlier this year, the domestic online fashion retailer Zando launched an international e-commerce division, Zando Global, which offers competition to Temu and Shein, another Chinese e-commerce platform that has made inroads in South Africa.

“Zando Global steps in as the local hero, offering a trustworthy alternative for those seeking international products without the uncertainties of ordering from abroad,” the company said at the launch.

However, with Temu’s supply chains in South Africa appearing to be strong, and given the company’s ability to provide consumers with extremely low-cost products, it is going to be challenging for African platforms to compete.

“If they keep improving the quality of their products, and keep improving on delivery times, Temu and other Chinese e-commerce platforms will continue growing their sales to retailers, small businesses, and consumers in Africa,” Byamungu says.

Want to continue reading? Subscribe today.

You've read all your free articles for this month! Subscribe now to enjoy full access to our content.

Digital Monthly

£8.00 / month

Receive full unlimited access to our articles, opinions, podcasts and more.

Digital Yearly

£70.00 / year

Our best value offer - save £26 and gain access to all of our digital content for an entire year!

Sign in with Google

Sign in with Google